Setting College Budgets and Financial Goals

College Budgets Start With Allowance

There is no high school class that will prepare your child for the expenses at college. September goes very well but October fines the cash low and the expenses high. How can it be that Halloween brings the need for additional cash money. This is no trick or treat. Students and just about everybody need to budget and curb spending. Expenses will always be part of life, but spending is a totally different subject.

Tiahara Hira, Professor at Iowa State University, “Relatively little attention has gone to the question of how college students themselves handle their finances. For the most kids, it’s the first time totally on their own, and they don’t know how to plan and budget.”

Teaching your college student about money and budgeting should have started in their youth. According to the Phoenix Student Fiscal Fitness Survey—few kids age 12 to 21 understand the basic financial terms. Only 12% could define budget. It is best to start kids understanding the concept of earn/save/spend at an early age. Start with an allowance and a savings plan. Make them save to buy something they want. Make them understand the importance of earning. If you talk to your children about money, you will be talking to them about how the world really works.

Creating a Budget or Plan

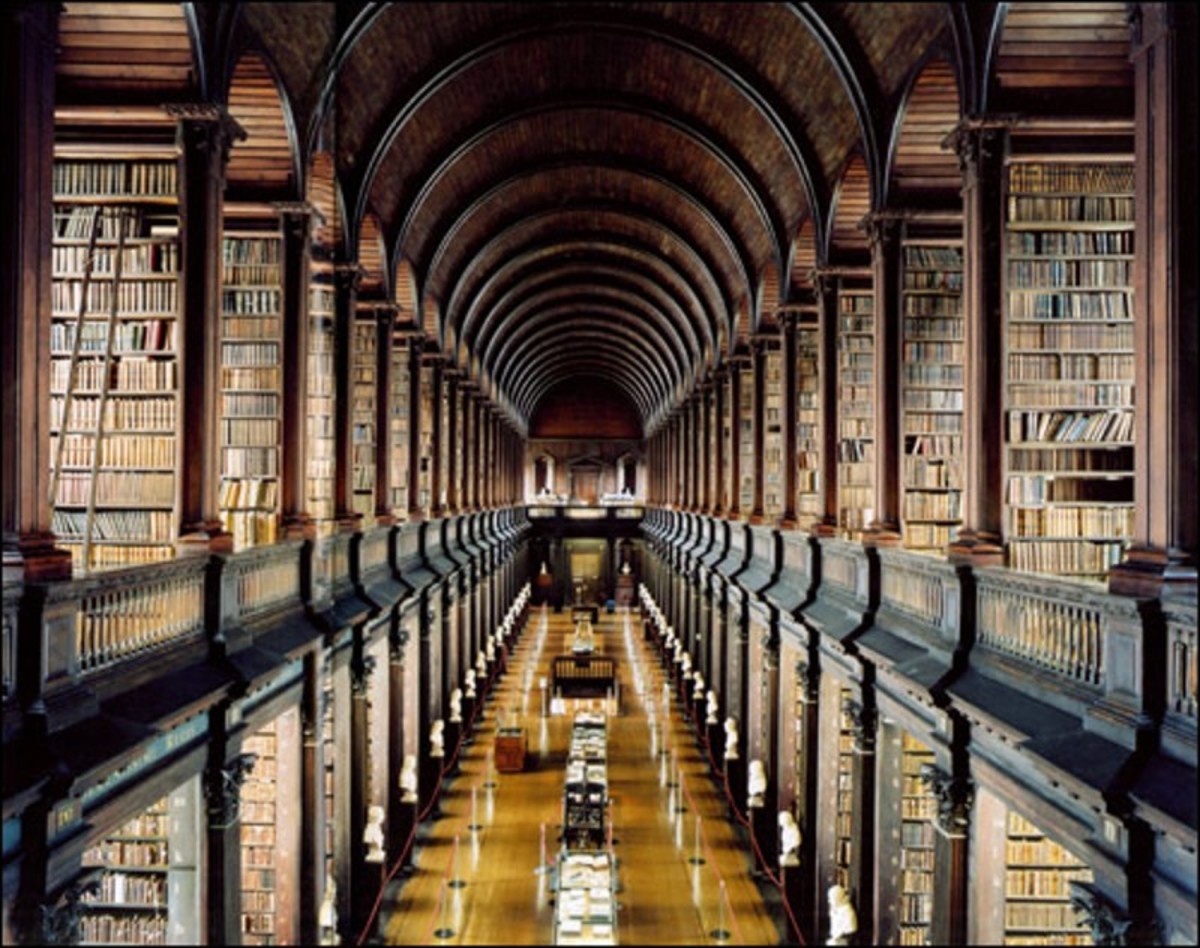

The U.S. Census Bureau reported the statistic when completing a college degree. In 2005, the average high school graduate income was $37,000; the average college graduate with a master’s degree was $85,000. There is a big adjustment from living with your parents to jumping into college life. Learning to stay on a budget using money management and financial planning pave the way for your future.

An education is what you need to get ahead and stay ahead in this world today. But, man does it come with a price tag. The average student loan for a bachelor degree is anywhere from $23 to $28 thousand dollars. Those individuals going for Master degree and Doctor Degree carry $40,000 upwards to $130,000, before they received the sheepskin.

Student needs to find out where they spend their money. Have them keep a list of all purchases and bills. Most importantly, keep track of cash spending. The few dollars unaccounted for can add up to a negative balance at the end of the month.

A budget is a personal financial plan. A good budget should allow you to save 10% of your earnings each month. A budget is a plan for saving and spending. You work hard for your money and you want to know where it is going and how much you are saving. To start a budget you need to total all your monthly income. At the same time you need to total all your monthly expenses. Now you know how much you make and how much you spend. College students should follow the same plan, with current exceptions. The expenses and income are different but the concept is the same.

Quick Choices Will Cost You

You want to be able to cover the expenses and not overspend. You need to decide how much money you will need each month. A budget starts with a list of all the things you will need. This is a ‘need’ list, not a want list. At the top of a college budget is books. We are not going to budget the tuition. That may be different amounts to each student. We are going to focus on the living expenses. Other expenses include: food, internet service, telephone, lab fees, clothing, and entertainment. Remember to make this as personal as you can. Each student has their own expenses according to their major and/or individual situation.

Books are a necessity, but they don’t have to be new. The book store has several used books available. This could be a good way to earn some additional cash after you have completed the course. Check bulletin boards or even ask students who have completed a course you are taking if they are willing to sell textbooks. This may be cheaper because bookstore also want to make money on the deal. An estimated amount for the cost of books is available at most college financial centers. This will give you a number to plug into your budget.

Food is a huge expense. Don’t just purchase the campus meal plan without first considering your needs. Your personal choice and eating habits should be the first decision. Will you try all types for foods, or are you a picky eater? Will your schedule allow you to get to the dining hall when it is open? Then you must consider the cost of the meal plan. Take the total cost of the plan and divide by the total of meals allowed. This might be a very high number, around $11per meal. Remember, you will pay for meal even if you don’t use them. If your menus are limited it may be worthwhile for you to purchase your own groceries. Consider how far the store is, and how you are going to get food to the dorm. Consider purchasing only dinner meals or lunch and dinner.

Don't Add Stress to Your Life

Without a plan you have a tendency to grab a coffee or a sandwich and think it doesn’t add up. Well, it does. Purchasing a coffee and muffin or spending just $5 a day adds up to $1,825 a year or just spending $30 a week for a lunch or dinner totals $1,560 a year. You could budget $15 per week just for an occasional pick me up and still stay within your budget.

By the time you have been accepted into college, you know how important it is to set goals. Setting your financial goals should be part of your college budget. The short term goal may be something as simple as completing college within $50,000 of loans. Long term goal would be to pay off student loans within five years, affording a rental, getting a car, moving to Philly. You need to set a goal so you have a target to aim at. Goals keep you focused and on course.

Your goal is to minimize expenses and maximize savings. Now that they have a physical list in front of them, the can see where they can cut expenses. They can see where the cash goes. How many are really necessary? Budgets are designed to be flexible especially when first starting. You might have forgotten expense and priorities shift as you get older. You can count on 3%

You need to keep good records and monitoring your budget. Forgetting to write down expenses can lead to short cash flow and disaster. The start of your college life is also the beginning of your financial wellbeing. Staying on track is a straight road to your success. It is much easier to purchase ‘wants’ when you have the cash. You will enjoy the fun times when you know it is not going to cost you an extra arm and a leg in interest or poor credit rating when you budget and stick with it.

Stress is a part of life. Don’t let your college budget contribute to your stress. To reduce stress you must first try to prevent it. Spending too much money and then worrying about how you are going to pay for things is not good for your stress level. And it is not necessary. You are in control; you have the power to make the right decisions. Set your budget; set your goals and reach the top.